If you’re planning to buy a home this year in the Tulsa Metro area (Bixby Oklahoma 74008, Jenks Oklahoma 74037, Kiefer Oklahoma 74041, Glenpool Oklahoma 74033, Mounds Oklahoma 74047, or Sapulpa Oklahoma 74066) saving for a down payment is one of the most important steps in the process. One of the best ways to jumpstart your savings is by starting with the help of your tax refund.

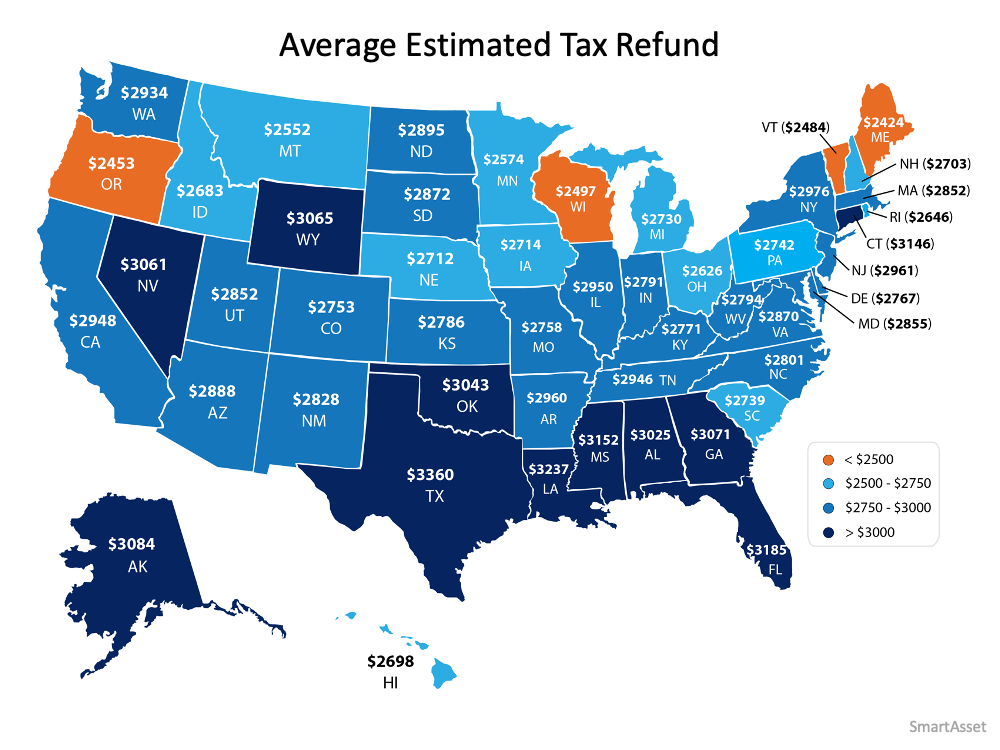

Using data from the Internal Revenue Service (IRS), it’s estimated that Americans can expect an average refund of $2,925 when filing their taxes this year. The map below shows the average anticipated tax refund by state: As you can see in Oklahoma the average tax refund is $3,043.

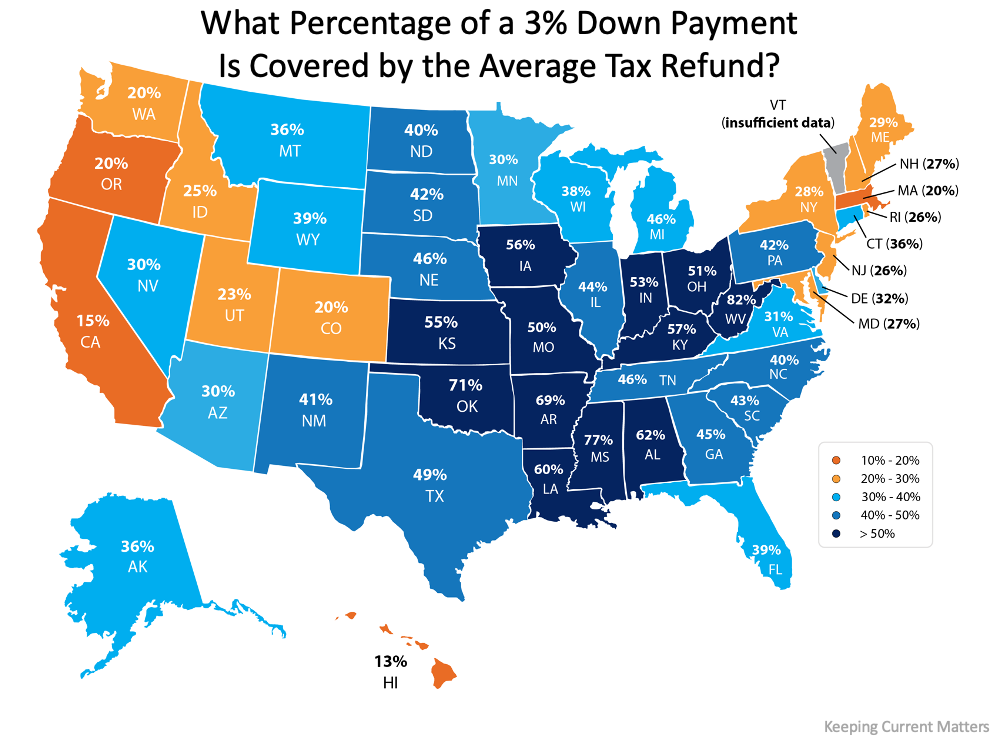

Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. There are a lot of options and working with a great real estate professional and lender is important! There are options for down payment assistance too, even for families making over $130,000 a year. Reach out to me, Sabrina Shaw, at Homes by Sabrina to discuss these options.

S0 How can your tax refund help?

If you’re a first-time buyer, your tax refund may cover more of a down payment than you realize.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average anticipated tax refund: In Oklahoma that is 71%.

The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home in our Tulsa Metro area.

Not enough money from your tax return?

A recent paper from the National Bureau of Economic Research found that, of the households that received a stimulus check last year, “One third report that they primarily saved the stimulus money.” If you had the opportunity to save your Economic Impact Payments, you may consider putting that money toward your down payment or closing costs as well. Again, there are options. Please reach out to me Sabrina Shaw, here at Homes by Sabrina as we would love to be your trusted real estate professional who can advise you and help you move up to your dream home or purchase your first home. There are options for all.

Bottom Line

Saving for a down payment can seem like a daunting task, but it doesn’t have to be. This year, your tax refund and your stimulus savings could add up big when it comes to reaching your homeownership goals along with some great down payment assistance programs.

#sabrinashawrealtor #sabrinashaw #homesbysabrina #toptulsarealtor #besttulsarealtor #oklahomarealestate #tulsarealestate #bixbyrealestate #jenksrealestate #kieferrealestate #buyahouseintulsa #918 #RE/MAX T-Town